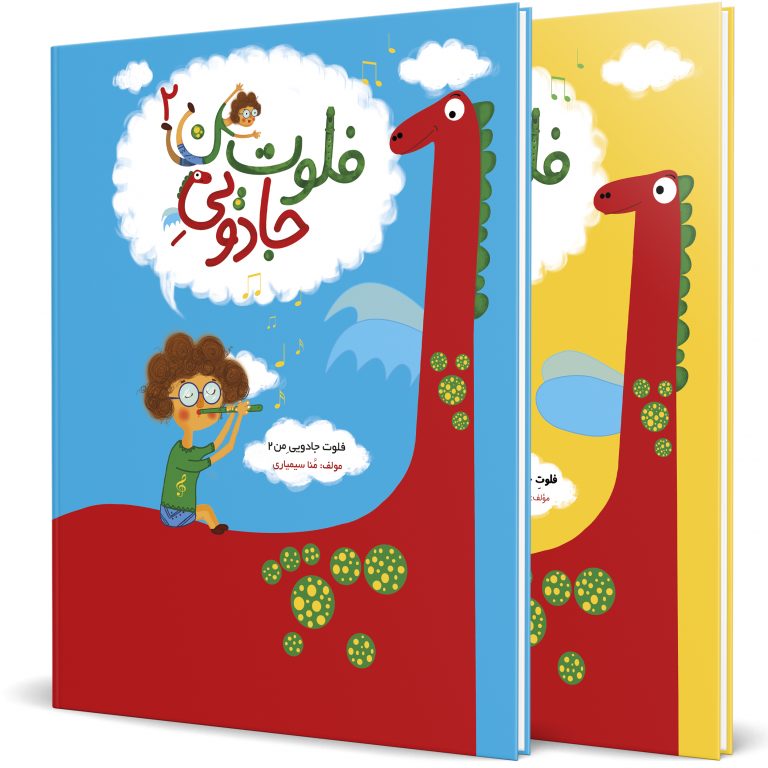

کتاب آموزش فلوت ریکوردر فلوت جادویی من

مجموعه کتاب فلوت جادویی من حاصل بیش از ۱۵ سال پژوهش و آموزش به صدها کودک ایرانی ست که توسط خانم منا سیمیاری، دانشآموختهی دانشگاه هنر تهران تالیف شده است. در مجموعهی دوجلدی فلوت جادویی من تلاش شده علاوه بر آموزش مبانی موسیقی، نحوهی نوازندگی فلوت ریکوردر برای تمامی سنین – بخصوص کودکان – آموزش داده شود. این مجموعه کتاب جدیدترین و به روز ترین کتاب آموزش فلوت ریکوردر محسوب میشود.

جلد اول کتاب فلوت جادویی من به آموزش فلوت ریکوردر به همراه آموزش مبانی موسیقی، آشنایی با نت ها، نحوهی دست گرفتن فلوت ریکوردر، دمیدن در فلوت ریکوردر و سایر الزاماتیست که هر هنرجوی مبتدی برای شروع نوازندگی به آن نیاز دارد.

در جلد دوم کتاب فلوت جادویی من، دروس متوسط تا پیشرفتهی نوازندگی با فلوت ریکوردر آموزش داده شدهاند. در این کتاب، در آموزش هر نت آهنگ آسان و سخت کنار هم قرار گرفتهاند تا هر کودک بر حسب پیشرفت و توانایی خود، درس جدید را بنوازد و سختی آهنگها مانع از پیشرفت کودکان با توانایی کمتر نشود. کتاب دوم شامل آهنگهای نامآشنا و معروفیست که کودکان از نواختن آنها بسیار لذت میبرند. نواختن نسخهی اصلیِ برخی از این آهنگهای مشهور برای کودک – یا برای نواختن با فلوت ریکوردر – دشوار هستند که طی سالها تلاش توسط استاد منا سیمیاری مولف کتابهای فلوت جادویی من، به نحوی تنظیم شدهاند که کودکان و افزاد مبتدی آنها را به راحتی فرا گرفته و بنوازند.

طی سالها تلاش خانم منا سیمیاری بعنوان مدرس سه تار و دورههای جامع موسیقی کودک، دروس این کتاب به مرور تدوین و تکمیل شده است. طی این سالیان تلاش شده بر اساس توانمندی کودکان و بازخوردهایی که در دورههای آموزشی ایشان دریافت شده است، محتوا و توالی دروس بهینه شوند، به نحوی که امروز مربیان موسیقی کودک با سبکهای آموزشی مختلف به کرّات ازعان داشتهاند که آموزش بر اساس این کتاب بسیار آسان بوده و کودکان با توانمندی های مختلف، به راحتی نت های موسیقی و نحوهی نواختن آنها با فلوت ریکوردر را میآموزند.

با انتشار رسمی کتاب اول فلوت جادویی من در سال ۱۳۹۸، به سرعت مورد استقبال مربیان موسیقی کودک با تجربهای در سراسر ایران قرار گرفت. اساتید بسیاری اعلام کردهاند که با بکارگیری این کتاب سرعت آموزش بسیار ارتقاء یافته و کودکان از بازیهای آموزشی طراحی شده در کتابهای «فلوت جادویی من» به شدت لذت میبرند.

فایلهای صوتی کتابهای فلوت جادویی من

کتاب فلوت جادویی من تنها کتاب آموزش فلوت ریکوردر است که علاوه بر فایلهای صوتی نتهای کتاب، به همراه فایلهای تنظیم شده آکومپانیمان (تنظیم ارکستری) ارائه میشوند. این مهم نوازندگی و تمرین فلوت ریکوردر را برای هنرآموز بسیار جذاب کرده و هنرجویان لذت نوازندگیِ فراتر از آماتور را تجربه میکنند.

فایلهای صوتی تمامی دروس کتاب فلوت جادویی من به صورتی جذاب با ارکستری

کودکانه تنظیم شدهاند و در

همین وبسایت

در دسترس خریداران کتاب قرار گرفتهاند. برای استفاده از این فایلهای صوتی کافیست بعد از ثبت نام و لاگین،

از کد فعالسازی موجود در کتاب برای بازگشایی قفل تمام دروس استفاده کنید.

(اگر کد را دریافت نکردید با ما

در واتزاپ

تماس بگیرید)

چطور کتاب را تهیه کنیم؟

- شما می توانید برای سفارش کتاب مستقیما با ما از طریق واتزاپ به شماره 09375388404 یا صفحهی اینستاگرام خانم منا سیمیاری با آیدی mona.simiari تماس بگیرید.

فایل های صوتی جلد 1

فایل های صوتی جلد 1 فایل های صوتی جلد 2

فایل های صوتی جلد 2